Page 20 - Power 100 Summit Booklet.pptx

P. 20

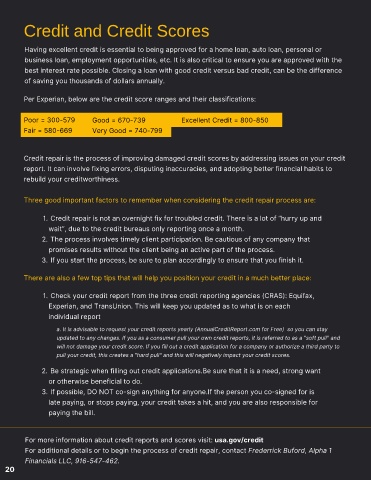

Credit and Credit Scores

Having excellent credit is essential to being approved for a home loan, auto loan, personal or

business loan, employment opportunities, etc. It is also critical to ensure you are approved with the

best interest rate possible. Closing a loan with good credit versus bad credit, can be the difference

of saving you thousands of dollars annually.

Per Experian, below are the credit score ranges and their classifications:

Poor = 300-579 Good = 670-739 Excellent Credit = 800-850

Fair = 580-669 Very Good = 740-799

Credit repair is the process of improving damaged credit scores by addressing issues on your credit

report. It can involve fixing errors, disputing inaccuracies, and adopting better financial habits to

rebuild your creditworthiness.

Three good important factors to remember when considering the credit repair process are:

1. Credit repair is not an overnight fix for troubled credit. There is a lot of “hurry up and

wait”, due to the credit bureaus only reporting once a month.

2. The process involves timely client participation. Be cautious of any company that

promises results without the client being an active part of the process.

3. If you start the process, be sure to plan accordingly to ensure that you finish it.

There are also a few top tips that will help you position your credit in a much better place:

1. Check your credit report from the three credit reporting agencies (CRAS): Equifax,

Experian, and TransUnion. This will keep you updated as to what is on each

individual report

a. It is advisable to request your credit reports yearly (AnnualCreditReport.com for Free) so you can stay

updated to any changes. If you as a consumer pull your own credit reports, it is referred to as a "soft pull" and

will not damage your credit score. If you fill out a credit application for a company or authorize a third party to

pull your credit, this creates a "hard pull" and this will negatively impact your credit scores.

2 .

1. Be strategic when filling out credit applications.Be sure that it is a need, strong want

or otherwise beneficial to do.

2. If possible, DO NOT co-sign anything for anyone.If the person you co-signed for is

3 .

late paying, or stops paying, your credit takes a hit, and you are also responsible for

paying the bill.

For more information about credit reports and scores visit: usa.gov/credit

For additional details or to begin the process of credit repair, contact Frederrick Buford, Alpha 1

Financials LLC, 916-547-462.

7 20